Bank Network Management

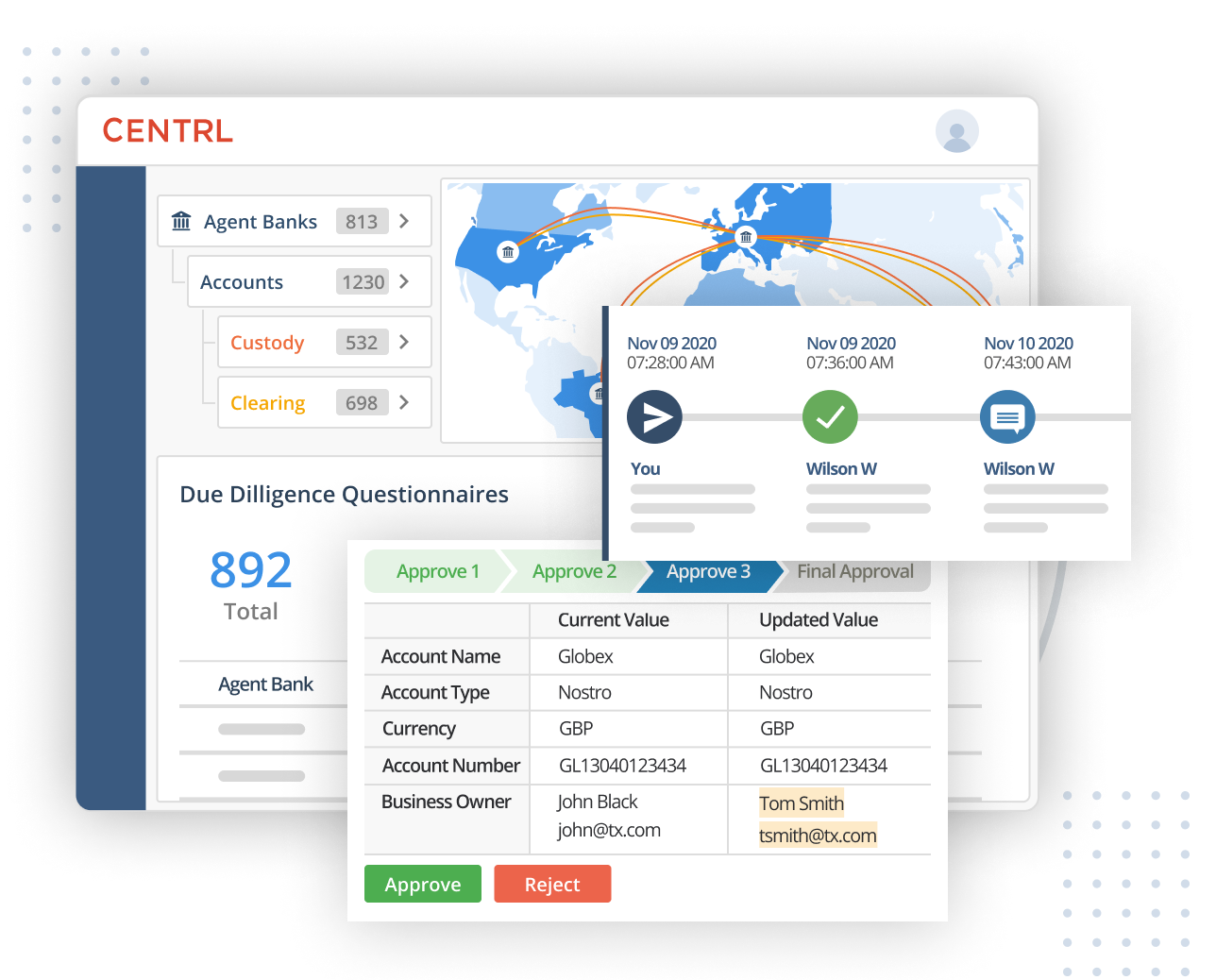

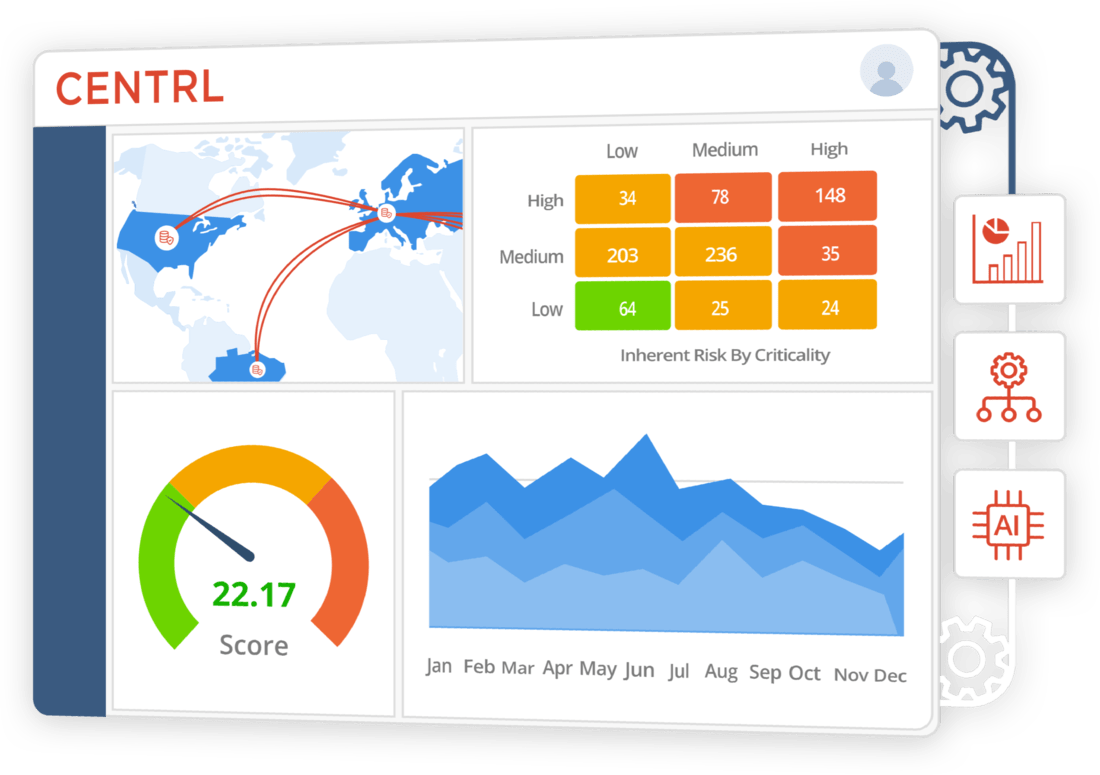

Banks manage the oversight of trillions of dollars in accounts with custodians and other third parties. With growing risk and regulatory pressure, they have a pressing need to automate their due diligence processes and bring sharper risk oversight. CENTRL offers the most advanced solutions for their needs. BNM360 is the most comprehensive Network Management platform for automating Account Management and Due Diligence with configurable workflows, deep analytics and ease of configuration.