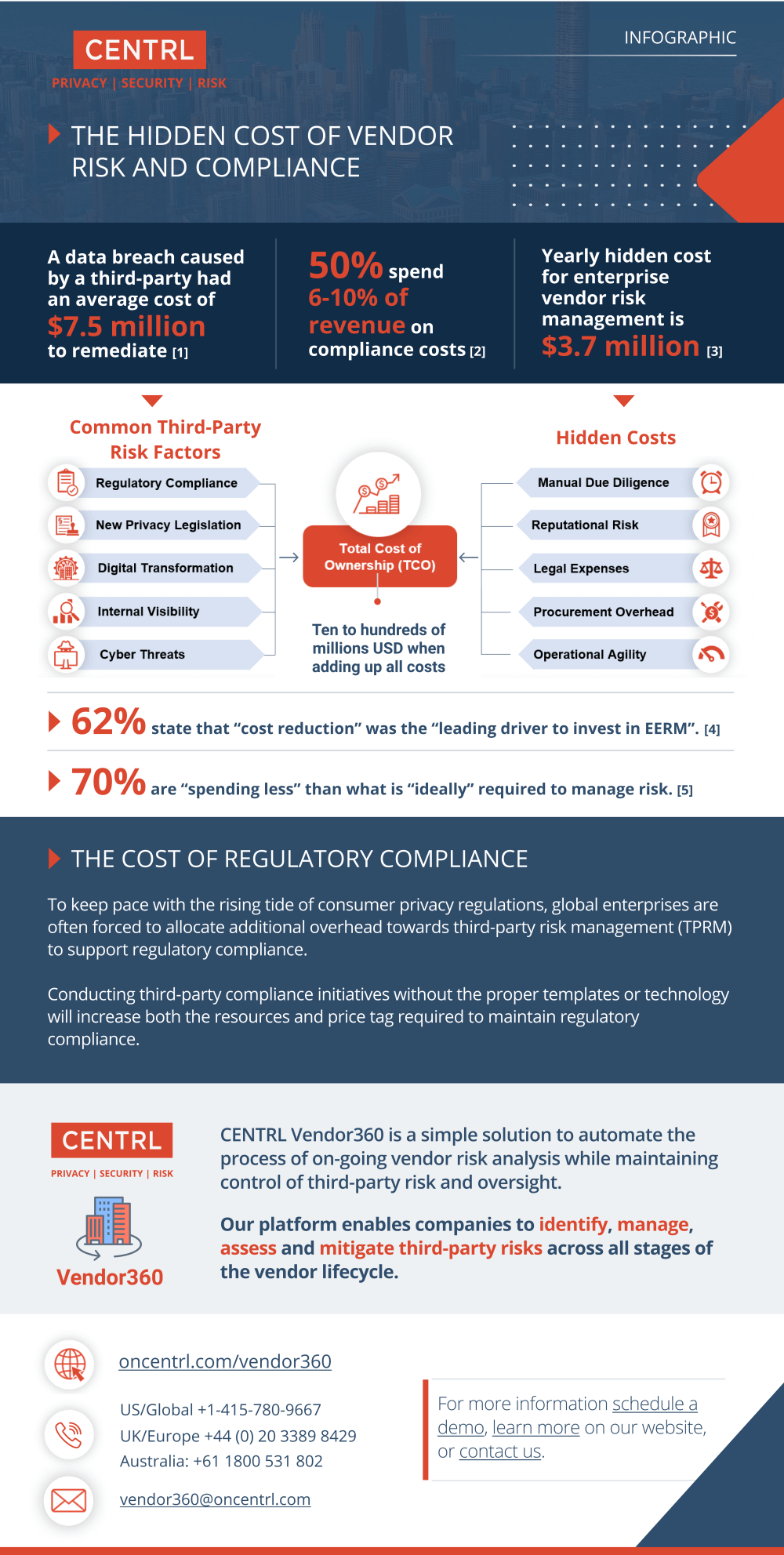

INFOGRAPHIC: The Hidden Cost of Vendor Risk and Compliance

The convergence of data privacy regulations and third-party risk management is generating new challenges for enterprise compliance and security teams. The complexities navigating the nuances of the shifting regulatory landscape and operationalizing the requirements are generating a considerable amount of confusion within the enterprise risk management marketplace.

Our latest series of infographics lays out vendor risk, compliance, and the cost to organizations. This blog post will highlight one of these infographics on the hidden cost of vendor risk and compliance and how companies can prevent financial losses.

Third Party Risk is Rising

There are seemingly countless third-party risk factors you may encounter. These include:

- Regulatory compliance

- New privacy legislation

- Digital transformation

- Internal visibility

- Cyber threats

You’re already spending on these items, but more needs to be done to counter these risks upfront in order to prevent further costs.

The Cost of Third Party Risk Management

To keep pace with the rising tide of consumer privacy regulations, global enterprises are often forced to allocate additional overhead towards TPRM to support regulatory compliance. According to a 2018 survey by the Risk Management Association, 50% of respondents said they spend 6-10% of revenue on compliance costs. Conducting third-party compliance initiatives without the proper templates or technology will increase both the resources and price tag required to maintain regulatory compliance.

2020 was a landmark year for consumer privacy regulations, with record breaking fines for HIPAA violations and multi-million euro fines for the newly implemented EU General Data Protection Regulation (GDPR). These regulations are also shifting towards how third-parties, often referred to as “data processors”, handle sensitive information.

To keep pace with the rising tide of consumer privacy regulations, global enterprises are often forced to allocate additional overhead towards third-party risk management (TPRM) to support regulatory compliance.

Conducting third-party compliance initiatives without the proper templates or technology will increase both the resources and price tag required to maintain regulatory compliance.

Enterprise risk management teams face a delicate balance between complex TPRM resourcing requirements and business efficiency.

The best benchmark to measure the cost of a TPRM program is the “Total Cost of Ownership (TCO)”. This is the sum of all direct and indirect costs required to develop, implement, and administrate the program.

The indirect costs, also known as “hidden costs”, are subjective and hard to quantify. According to a 2019 survey of 554 IT and security professionals, the yearly hidden cost of managing vendor risk is $3.8 million. The variables below are the most common hidden costs driving up TCOs of third-party risk management programs:

- Managing due diligence

- Reputational risk

- Legal expenses

- Procurement overhead

- Operational agility

Integrating continuous monitoring into a TPRM program is a complex process without the proper tools or technology. But a properly provisioned continuous monitoring solution will enable a TPRM program to run more efficiently with real-time insights into supplier risk, reducing the time and cost required to conduct vendor risk analysis and provide predictive analytics to forecast risk throughout the duration of the vendor relationship.

Enterprises are searching for new solutions to bridge the gap between the resources required for a comprehensive third-party risk management program and business efficiency.

These automated third-party risk management solutions should be centered around the principles of risk identification, assessment, and response. This fundamental framework enables enterprise risk management teams to proactively assess potential third-party risk factors and mitigate identified vulnerabilities in a timely cost-effective manner.

Vendor360, CENTRL’s Third Party Risk Management Solution

CENTRL Vendor360 is a simple solution to automate the process of on-going vendor risk analysis while maintaining control of third-party risk and oversight. Our platform enables companies to identify, manage, assess, and mitigate third-party risks across all stages of the vendor lifecycle.

For more information schedule a demo, learn more on our website, or contact us.